(WS News) – Iran is facing one of its most severe economic crises in decades, with the rial hitting unprecedented lows against the U.S. dollar. By early January 2026, the open-market exchange rate hovered near 1,457,000 rials per dollar, reflecting years of inflation, weak growth, and political instability. For ordinary Iranians, this is not just a number—it is a daily struggle to preserve purchasing power amid soaring prices and economic uncertainty.

Why the Rial Isn’t Literally “Zero”

Despite media claims, the Iranian rial cannot go literally to zero. What citizens experience, however, is a functional zero in purchasing power. The main factors are:

- Inflation Outpacing Wages – With inflation exceeding 42% in December 2025, everyday goods cost far more than what wages can cover.

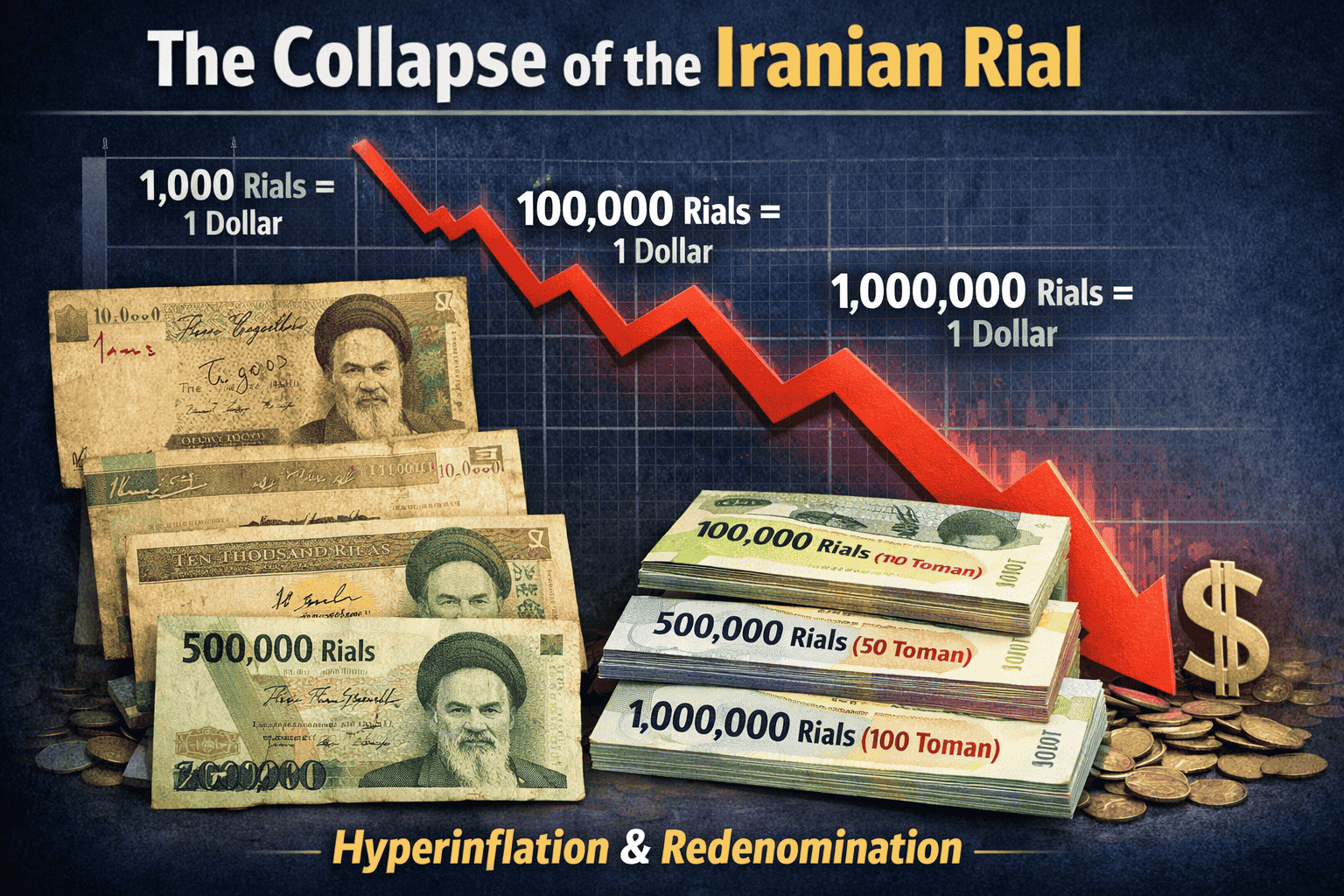

- Exchange Rate Escalation – The rial has added zeros over time, moving from hundreds of thousands to over a million per dollar, making transactions cumbersome.

- Redenomination – Iran’s parliament approved a plan to remove four zeros from the rial, set to roll out over three years. While it simplifies accounting, it does not stop inflation unless fiscal and monetary policies improve.

The Multi-Tier Currency System Worsening the Crisis

Iran operates three main exchange rates:

- Official rate: 42,000 rials/USD

- Preferential import rate: 285,000 rials/USD

- Open market rate: ~1,457,000 rials/USD

The 35x gap between the official and open-market rates encourages speculation, arbitrage, and erodes confidence in the rial. Households and businesses often ignore official rates, relying instead on the street rate to determine real purchasing power.

Factors Driving the Current Collapse

- Sanctions and Restricted Dollar Access – U.S. sanctions limit oil exports and foreign currency flows, creating scarcity.

- Persistent Inflation – Annual inflation over 40% makes cash holdings a losing strategy.

- Weak Economic Growth – Iran’s GDP is projected to contract further, reducing government revenue and increasing fiscal pressure.

- Policy Shocks – Recent changes forced importers to source foreign currency at market rates, raising demand instantly.

- Political Unrest – Protests, strikes, and a tense socio-political climate accelerate depreciation as citizens lose faith in the state’s ability to stabilize the economy.

Protests: Economic Strain Meets Political Frustration

The December 2025 protests marked a turning point. Merchants, students, truckers, and oil workers marched in cities like Tehran, Mashhad, and Shiraz, demanding reform and criticizing government corruption. President Pezeshkian attempted a conciliatory approach, promising subsidies to ordinary citizens while cracking down on privileged insiders.

Yet, the protests reveal structural weaknesses:

- Lack of a unifying opposition figure

- No major defections from security forces

- Ongoing reliance on multi-tiered FX controls

These demonstrations underscore the connection between economic collapse and regime fragility, as citizens face both hyperinflation and infrastructure shortages, including electricity, gas, and clean water.

Bitcoin and Crypto: A Lifeline Amid Collapse

As trust in the rial erodes, many Iranians explore alternative stores of value, including U.S. dollars, gold, stablecoins, and Bitcoin.

Bitcoin plays a dual role:

- Hedge: Preserves value when fiat currencies weaken, despite price volatility.

- Lifeline: Enables peer-to-peer transfers even during internet blackouts or restrictions on traditional banking systems.

Iran’s government, however, has capped stablecoin holdings and restricted crypto on-ramps, demonstrating the tension between censorship-resistant money and state monetary control.

Historical parallels include:

- Cyprus (2013), where Bitcoin surged amid banking freezes

- Argentina, Lebanon, and Turkey, where repeated devaluations drove crypto interest

What’s Next for Iran?

Analysts outline three scenarios:

- Deepening Crisis – Currency weakens further, unrest continues, controls tighten, and crypto demand rises.

- Repression – Crackdowns stabilize the streets temporarily but fail to address inflation or structural economic issues.

- Sanctions Relief or Policy Reset – Leadership change or trade normalization could stabilize the rial and shift crypto demand toward speculation rather than survival.

Key indicators to watch:

- Open-market rial exchange rate

- Inflation and food price trends

- Implementation of redenomination

- Political developments and protest activity

Conclusion

Iran’s currency crisis is a stark reminder that money is more than just a medium of exchange—it is a reflection of trust, governance, and economic stability. While redenomination can make numbers readable, the rial’s recovery depends on fiscal discipline, policy reform, and social stability.

Until these fundamentals are addressed, Iranians will continue seeking alternatives like Bitcoin, gold, and foreign currency to protect their purchasing power, demonstrating how financial innovation thrives amid monetary collapse.